Financial health is built on habits. You don’t need major changes to see major results — you need consistent monthly routines that keep you focused and accountable.

Set aside one day each month to review your progress. Check your balances, spending, and goals. This keeps your financial plan on track.

Understanding where your money goes helps you make informed decisions. Track spending in categories like food, utilities, transportation, and entertainment.

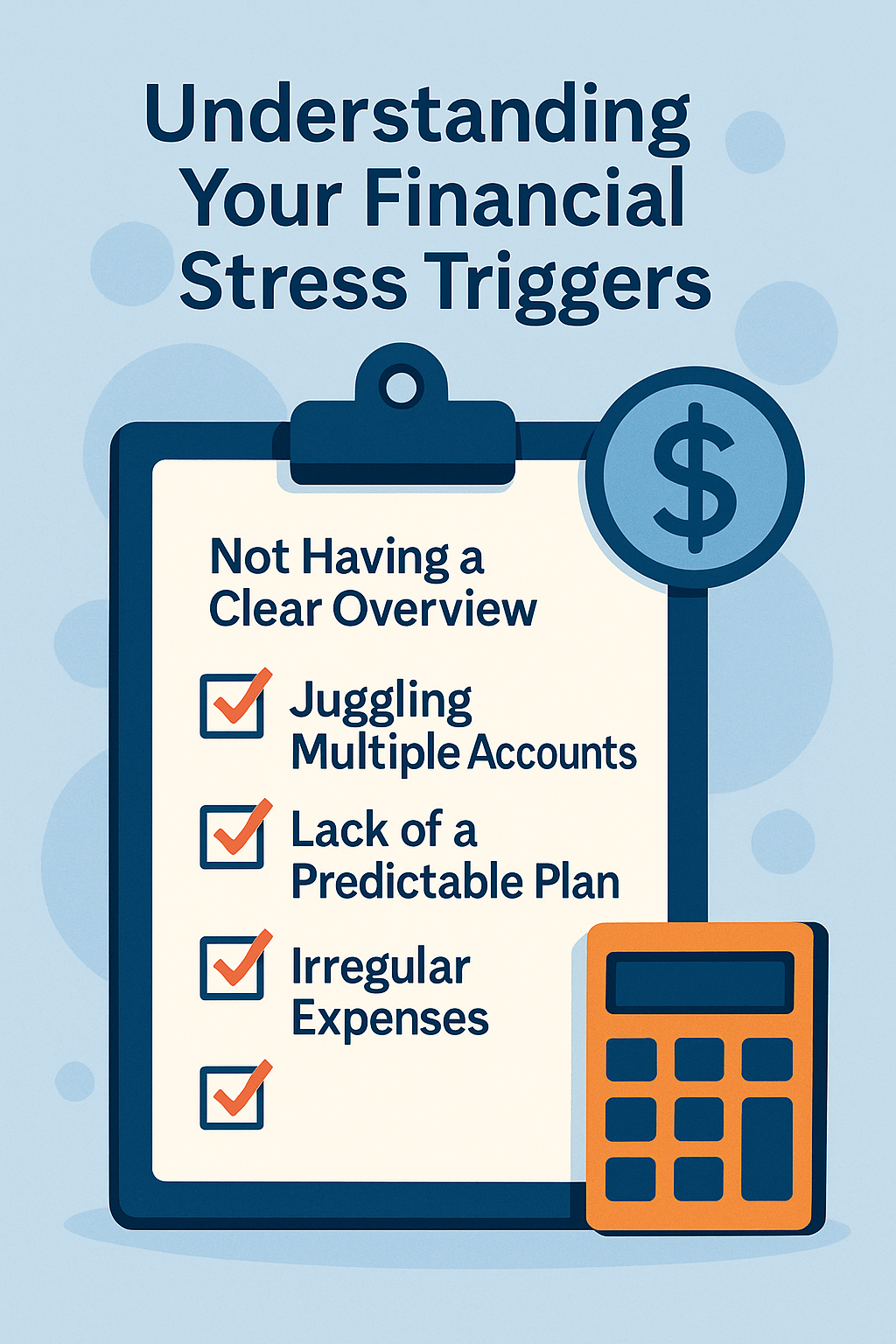

Some expenses appear regularly but not monthly — gifts, school supplies, car maintenance. Build small monthly reserves so these moments never feel stressful.

Many households can save significantly simply by eliminating unused subscriptions or memberships. Do a quick audit each month.

Progress matters, even when it feels small. Recognizing wins keeps you motivated and committed.

Improve your monthly finances by seeing what plans are available here