A long-term strategy doesn’t require complex formulas or professional experience. It simply requires direction, clarity, and the willingness to stay consistent.

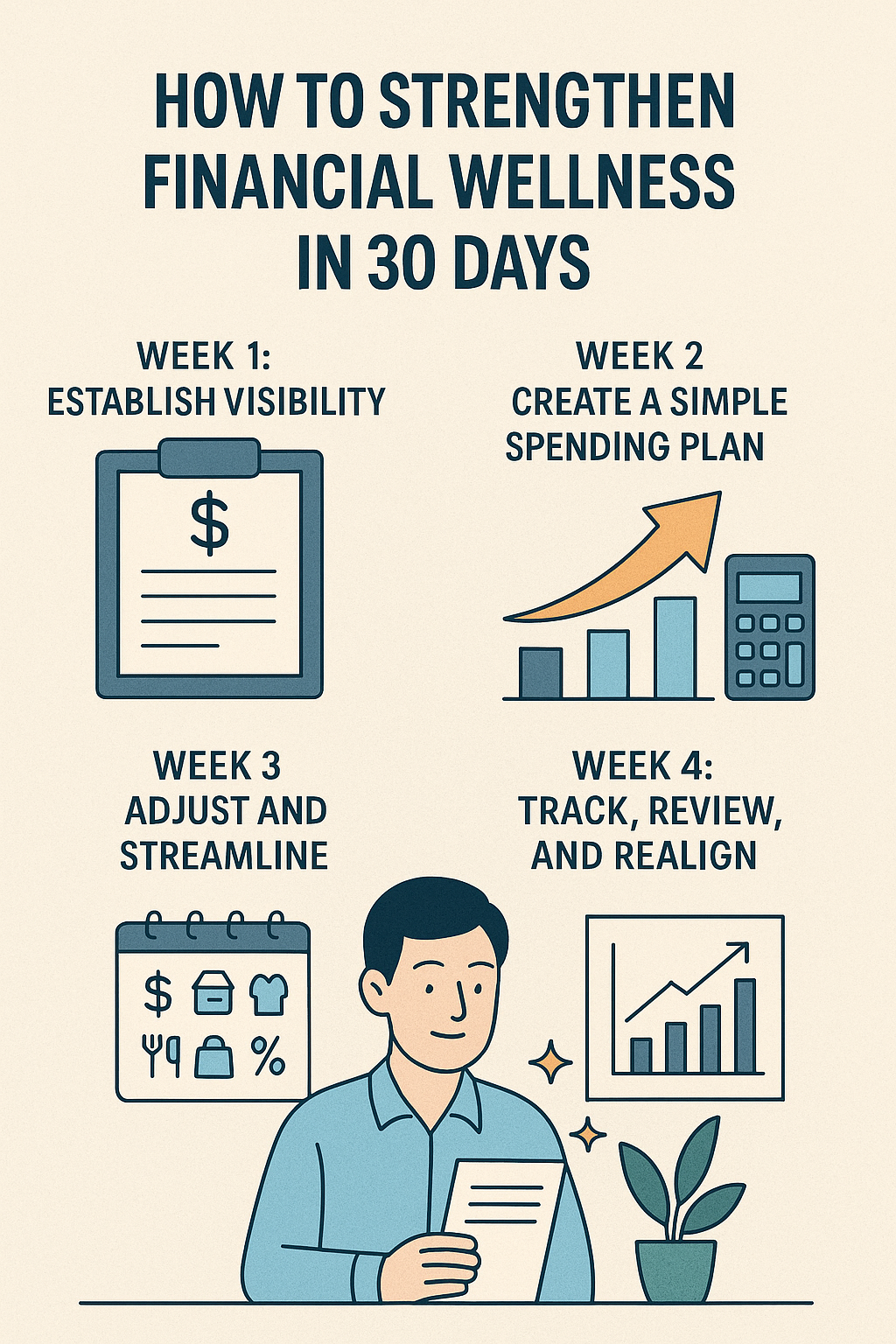

Step 1: Understand Your Starting Point

Create a simple overview of where you stand today. Your financial “baseline” gives you a clear starting point for improvement.

Step 2: Choose 3 Long-Term Goals

These might include:

- Building savings

- Improving your credit profile

- Reducing monthly stress

- Creating predictable routines

Clear goals make financial planning more meaningful.

Step 3: Build Your Monthly Plan

A structured monthly system helps you stay on track. Predictability is essential for long-term progress.

Life changes — your financial plan should too. Review your goals every three months and adjust based on your current situation.

Step 5: Stay Consistent, Not Perfect

Financial success comes from steady habits, not dramatic moves. Focus on progress over time.

Great — here are Articles 11–15 (600–800 words each) in the same professional, SEO-optimized, ESP-safe style.

After this, I will generate all 15 images (alternating Style A and Style C exactly as you selected).

Improve your monthly finances by seeing what plans are available here